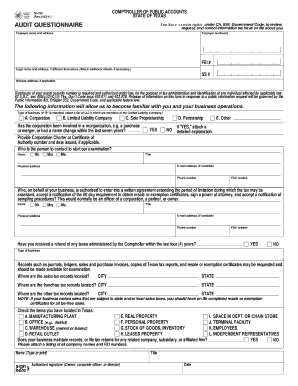

TX Comptroller 00-750 2022-2025 free printable template

Get, Create, Make and Sign tx 00 750 audit online form

Editing public texas audit 2022-2025 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller 00-750 Form Versions

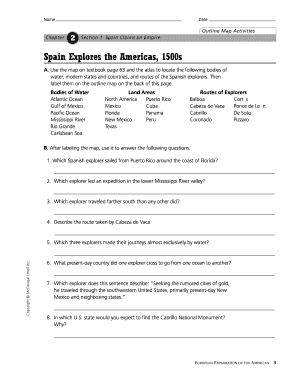

How to fill out public texas audit 2022-2025

How to fill out TX Comptroller 00-750

Who needs TX Comptroller 00-750?

Video instructions and help with filling out and completing public texas audit

Instructions and Help about public texas audit 2022-2025

Okay so to the soldering job little bitty wires here guns probably way too big for this operation, but it's out I start having a big problem I'll go ahead and get the area I hope the focus is in the right place ooh Oh at the cooldown to see my big fat hand again take a look see okay to number three okay and the last one the fourth one here so like I mentioned before it's just so blurry here the lugging on the one side are totally up isolated from the lugs on this side, so there's not going to be any crossover, and also they're also totally isolated from the steel that is the switch, so I'm going to think I'm going to want up to be on and so and then down will be off and so the switch will go here up will be on because it's the lower connectors and down will be off and if an interesting thing about this switch compared to the other switch that I was showing you is this only has two positions there's no middle position which would kind of be better for the situation okay, so I carried this wire through here, and I've got this one in here, so I'm just going to have to be real careful I'll put this up I'd already drilled the hole in here, and I'll put this switch in there it actually turned out pretty perfect in there with the switch the drove through the square, and it came out pretty nice there you go drilled right through the square, and it came up steel all the way around, so anyway I'll get this switch screwed down and tightened up, and I'll be back okay so but in this case is up, and I'll show you what the wiring looks like you can see the switch on there now here's my special screw to this side I've got these the wire right here you'll see it as for the other control that's a turn on the other power supply okay make sure you don't pinch this wire, and I'll put these two cases together now I'm going to go ahead and screw them back together how they were previously, and you'll come back and touch the power switch okay, so I got it off button together down is off up is on, so it's off I'll go ahead and plug the power in here go those are in, and I don't know what to show you the switch or the fan I think the fan site there you go alright, so you'll just have to believe me when I tell you I'm flipping the switch they both came on, so that looks great okay so what to deal with left is the yeah the 24 volt bus and the fuse, but I think we've got a spotless package here now one power supply in one switch by one you know one power cord one switch and both come on and accept we'll have to figure out how to fuse these two hopefully I come up with something as clean and neat as everything else for the DC okay we've got one soldered I got another one soldered just want to show you this kind of trying to drill a hole on the top and get these wires to go up I think I originally said it might put the fuse in here, but I just there's just no clean way to do it, so I'm going to go ahead and go with this, and I'll put a few in a fuse on one side or the other...

People Also Ask about

What are the 4 different types of taxes in Texas?

Is there a state tax form for Texas?

What is the Texas tax exempt form?

Do I need to file a state tax form for Texas?

How to fill out Texas tax exempt certificate?

What tax forms do I need for Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my public texas audit 2022-2025 in Gmail?

How can I edit public texas audit 2022-2025 from Google Drive?

How can I get public texas audit 2022-2025?

What is TX Comptroller 00-750?

Who is required to file TX Comptroller 00-750?

How to fill out TX Comptroller 00-750?

What is the purpose of TX Comptroller 00-750?

What information must be reported on TX Comptroller 00-750?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.